Africa Fertilizers Market Size and Share

Africa Fertilizers Market Analysis

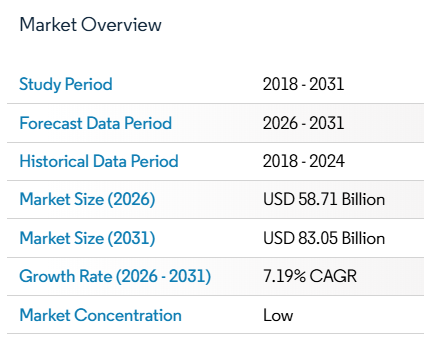

The Africa fertilizer market was valued at USD 54.77 billion in 2025 and estimated to grow from USD 58.71 billion in 2026 to reach USD 83.05 billion by 2031, at a CAGR of 7.19% during the forecast period (2026-2031). Steady policy alignment across the continent and domestic capacity expansions support this advance as governments prioritize input self-sufficiency and food security. Complex fertilizers dominate volumes by offering balanced nutrient packages that fit precision programs, while straight urea gains cost tailwinds from new Nigerian plants. Digital agronomy, green ammonia investments, and targeted subsidies are broadening smallholder access and stimulating private capital flows toward distribution upgrades. Persistent logistics gaps and recurring global price spikes remain headwinds, but sustained demand for nutrient-dense staple production underpins a resilient growth outlook for the Africa fertilizer market.

Keys

- By Type, complex fertilizers led with 58.02% of the Africa fertilizer market share in 2025, while complex fertilizers are predicted to grow at an 8.27% CAGR through 2031.

- By Form, conventional led with 90.76% of the Africa fertilizer market size in 2025, while conventional form is projected to expand at a 7.14% CAGR to 2031.

- By Application mode, fertigation led with 60.93% of the Africa fertilizer market size in 2025, while foliar application is projected to expand at an 8.27% CAGR to 2031.

- By Crop type, field crops accounted for a 90.88% share of the Africa fertilizer market size in 2025, while field crop are predicted to grow at a 7.14% CAGR through 2031.

- By Geography, Nigeria led with 12.37% of the Africa fertilizer market size in 2025, while South Africa is advancing at a 6.41% CAGR through 2031.

Africa Fertilizers Market Trends and Insights

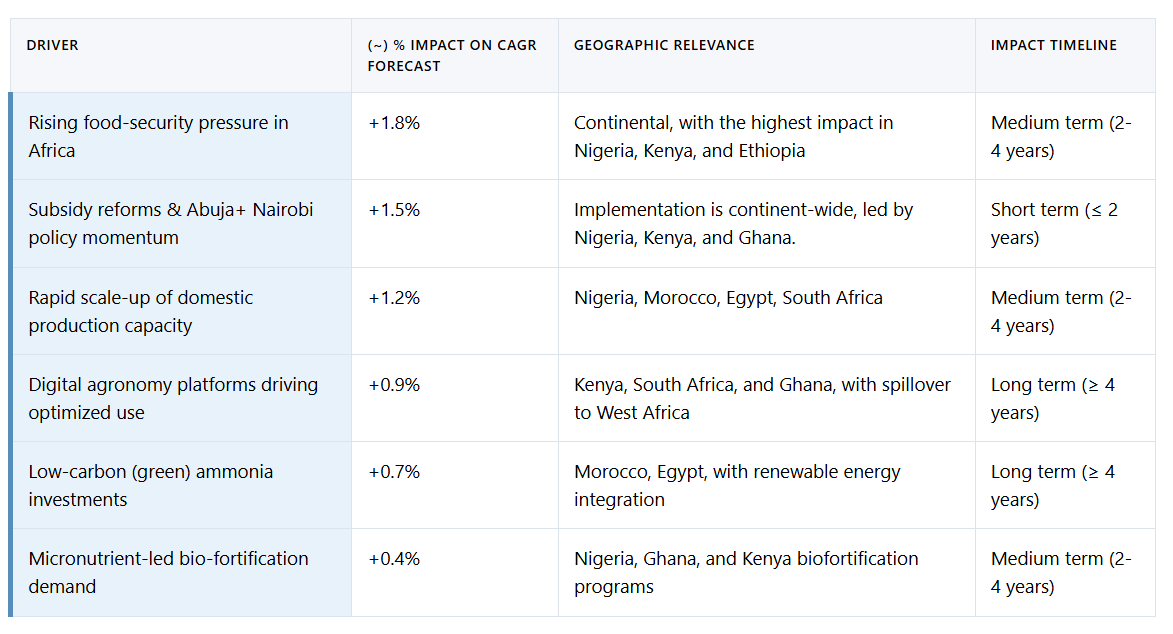

Drivers Impact Analysis

- Rising Food-Security Pressure in Africa

- Subsidy Reforms & Abuja Nairobi Policy Momentum

- Rapid Scale-Up of Domestic Production Capacity

- Digital Agronomy Platforms Driving Optimized Use

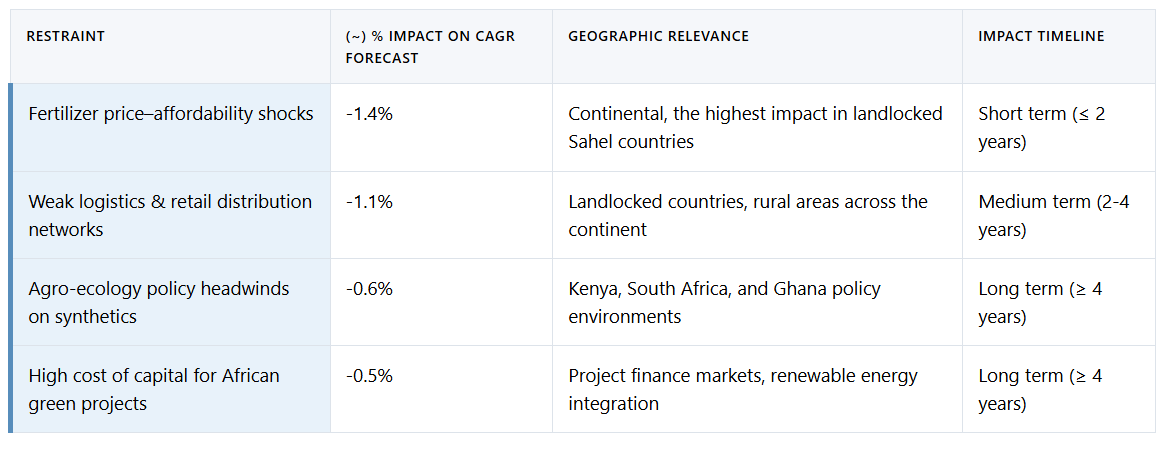

Restraints Impact Analysis

- Fertilizer Price–Affordability Shocks

- Weak Logistics and Retail Distribution Networks